For instance, dog owners would have an entire category devoted to pet care costs.

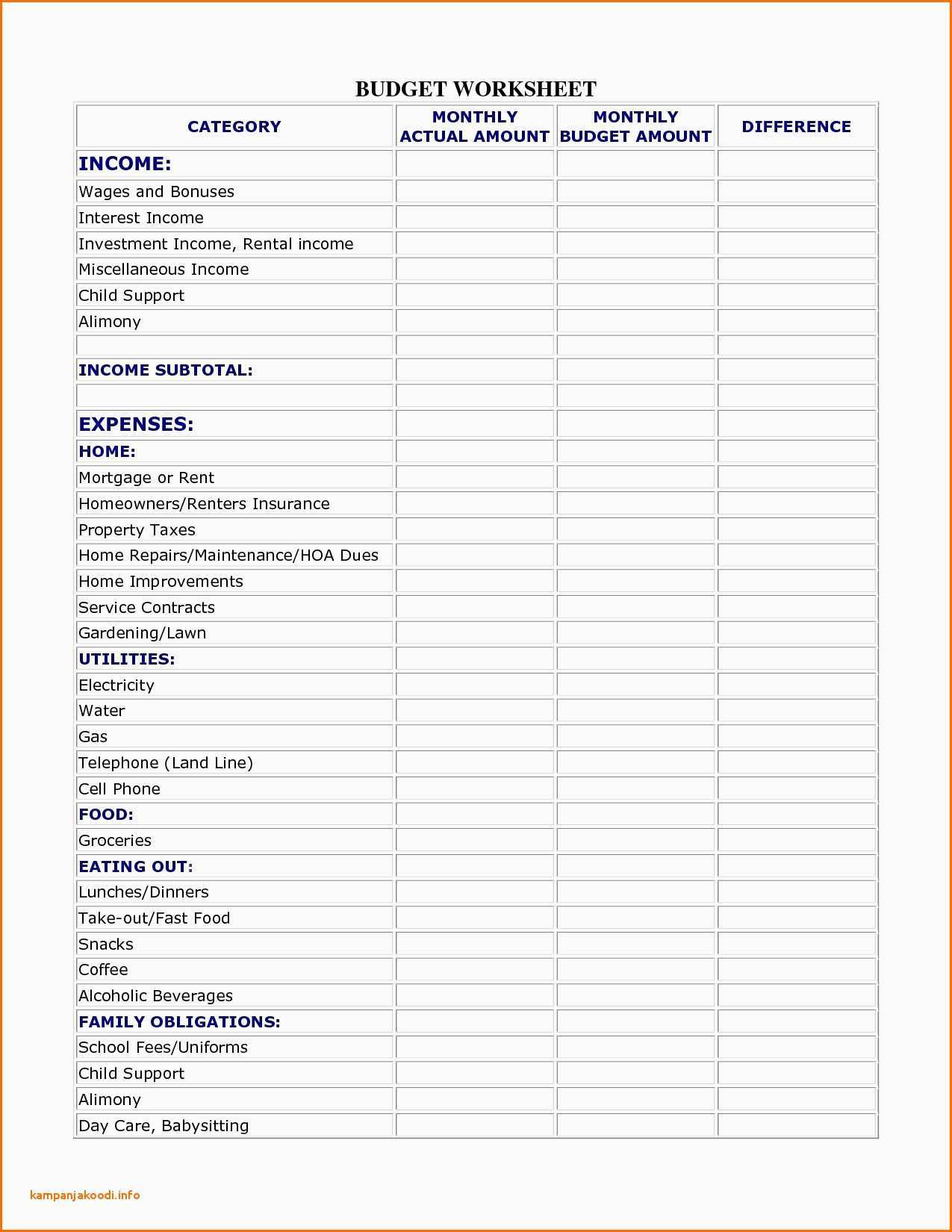

Keep in mind that your monthly household expenses list will be tailored to your lifestyle. My monthly budget example above takes into account sample expenses for a family like mine. Some subcategories like meat, poultry, fish, eggs and beef grew by double digits. Use This List of Expenses as a Starting Point Monthly Expenses Vary by Family. Having a budget helps you manage your money, control your spending, save more money, pay off debt, or stay out of debt. The three categories are seeing many cost components increase at their fastest pace in many years.įor example, the "food at home" index (i.e., groceries) rose 6.4% over the past year, the largest 12-month increase since December 2008. Making a budget is a key piece of a strong financial foundation. Transportation costs (like vehicle purchases and gasoline) ate up 16% of the budget, and food expenses (groceries and restaurants) another 12%. In 2020, housing costs (like rent and utilities) represented about 35% of the average person's budget.

#HOUSEHOLD EXPENSES EXAMPLES HOW TO#

More from Personal Finance: Here are some tips to avoid inflation's sting as prices jump How to prepare for a big heating bill this winter Here's an investment option to protect against inflation Every few months, revisit your budget and adjust as necessary. Housing, transportation and food are generally the three biggest expense categories for the average American household each year, according to the Consumer Expenditures Survey. Add up your expenses for each category of needs, wants and savings/debts, then plug in your monthly net income below. Personal Loans for 670 Credit Score or Lower Personal Loans for 580 Credit Score or Lower Best Debt Consolidation Loans for Bad Credit

0 kommentar(er)

0 kommentar(er)